ZAKAT

At Muslim Response USA, we are extra cautious while dealing with Zakat funds and make sure that the beneficiaries fall under the eight designated categories as defined in the Holy Quran and specified by the Holy Prophet Muhammad SAW.

Muslim Response USA has 100% Zakat Policy, which means that we don’t use your Zakat money for paying staff salaries, marketing, fundraising, and any other expenses for running the charity, and your Zakat is used only to help those in need – in accordance with Islamic principles.

What is Zakat?

As one of the five Pillars of Islam, Zakat (“that which purifies”) is a religious obligation for all Muslims who meet the necessary criteria of wealth. It is a mandatory charitable contribution, the right of the poor to find relief from the rich, and is worship not a tax. Primarily, Zakat constitutes the Islamic welfare system that re-distributes money and property in society from those who have it in sufficient quantities to those whose holdings do not rise to that minimum. Allah SWT has declared Zakat compulsory on all eligible Muslims and has instructed them many times in the Holy Quran to perform Salat and pay Zakat.

What is Nisab?

Zakat is calculated based on income and the value of all of one’s possessions. It is customarily 2.5% of a Muslim’s total savings and wealth above a minimum amount known as Nisab. There are two measures to determine Nisaab – gold (3 ounces or 87.48 grams, or its cash equivalent) or silver (21 ounces or 612.36 grams, or its cash equivalent). The most common Zakatable wealth is cash on hand and in banks, stocks, and retirement and savings funds. Zakat is not paid on wealth used for debt repayment of living expenses such as food, clothing, housing, health, education, transportation etc. Gold and jewelry are not exempt from Zakat and their worth should be factored into total yearly savings.

WHO CAN RECEIVE ZAKAT?

The Quran has mentioned in Surah al-Tawbah the following eight categories of eligible Zakât recipients:

- The poor (al-fuqarâ’)

- The needy (al-masâkîn)

- Zakât-Collectors

- Those sympathetic to Islam

- Those in bondage (to free slaves and captives)

- The debt-ridden

- In the cause of God

- The wayfarer (the stranded travelers)

Those who [duly] establish the Prayer and who spend [charitably] out of what We have provided them—it is these who are, in truth, the believers. For them, there are [lofty] ranks [awaiting] with their Lord, and forgiveness, and a generous provision.

(Al-Anfâl, 8: 3-4)

When is Zakat due?

Zakat is due after one Lunar (Hijri) year starting from either the first day you acquired the amount of Nisab or the day you paid Zakat last year. The month of Ramadan is considered to be the best time to pay Zakat for better reasons.

How Muslim Response USA uses Zakat?

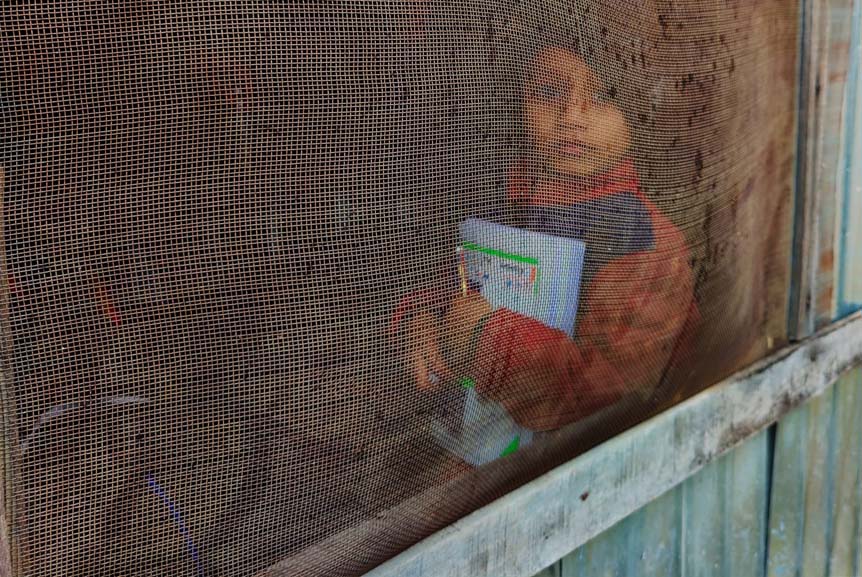

Muslim Response USA considers Zakat, Sadaqah, and other donations from our generous donors as sacred Amanah and we are answerable to our donors and Allah SWT for each and every penny that we spend. We ensure utmost care and transparency while spending funds for providing much-needed humanitarian assistance and basic social services (health, education, livelihoods, water, sanitation & hygiene etc.) to the poorest of the poor around the globe. We are extra cautious while dealing with Zakat funds and make sure that the beneficiaries fall under the eight designated categories as defined in the Holy Quran and specified by the Holy Prophet Muhammad SAW.